Stocks rallied, encouraged by economic data from Germany and China, in the absence of U.S. economic data. Germany’s Ifo business-climate index rose to 101.4 in November from 100 in October, beating expectations for a decline. The HSBC PMI showed that China’s manufacturing sector expanded in November for the first time in 13 months, indicating that growth will pick up in the fourth quarter. Wal-Mart and Target gained 1.9% and 1.2% respectively on Black Friday sale’s hopes. Tech stocks outperformed with Research In Motion soaring 13.7% after an analyst for National Bank in Toronto raised his price target to $15 from $12, reflecting an increased shipment target for the new BlackBerry 10 smartphone handsets expected to launch in February. Solid gains also came from Hewlett-Packard, Microsoft, Cisco, Intel and Dell. In the coming week investors will focus on Congress negotiations on fiscal cliff. Also, data on durable-goods orders for October, FHFA home-price index and Case-Shiller home price index for September, November consumer-confidence data, Fed’s Beige Book, Q3 GDP revision and new-home sales data are due. Euro-zone finance ministers resume talks with the IMF on conditions for giving Greece its next installment of 31.5 billion euros. Implied volatility inched lower on light trading volumes.

skip to main |

skip to sidebar

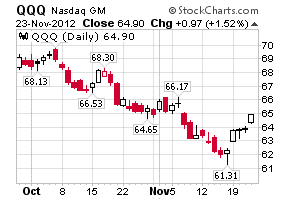

Receive Fresh Trading Ideas from OptionSmart.com Ahead of Opening Bell. Ride QQQ (NASDAQ-100) Trends Using Advanced Trading Strategies.

Experiencing delays in receiving Morning Updates via email? Re-subscribe here:

|

|